BFC

The Building Financial Capability (BFC) programme helps people and whānau to improve their financial wealth and wellbeing and get control

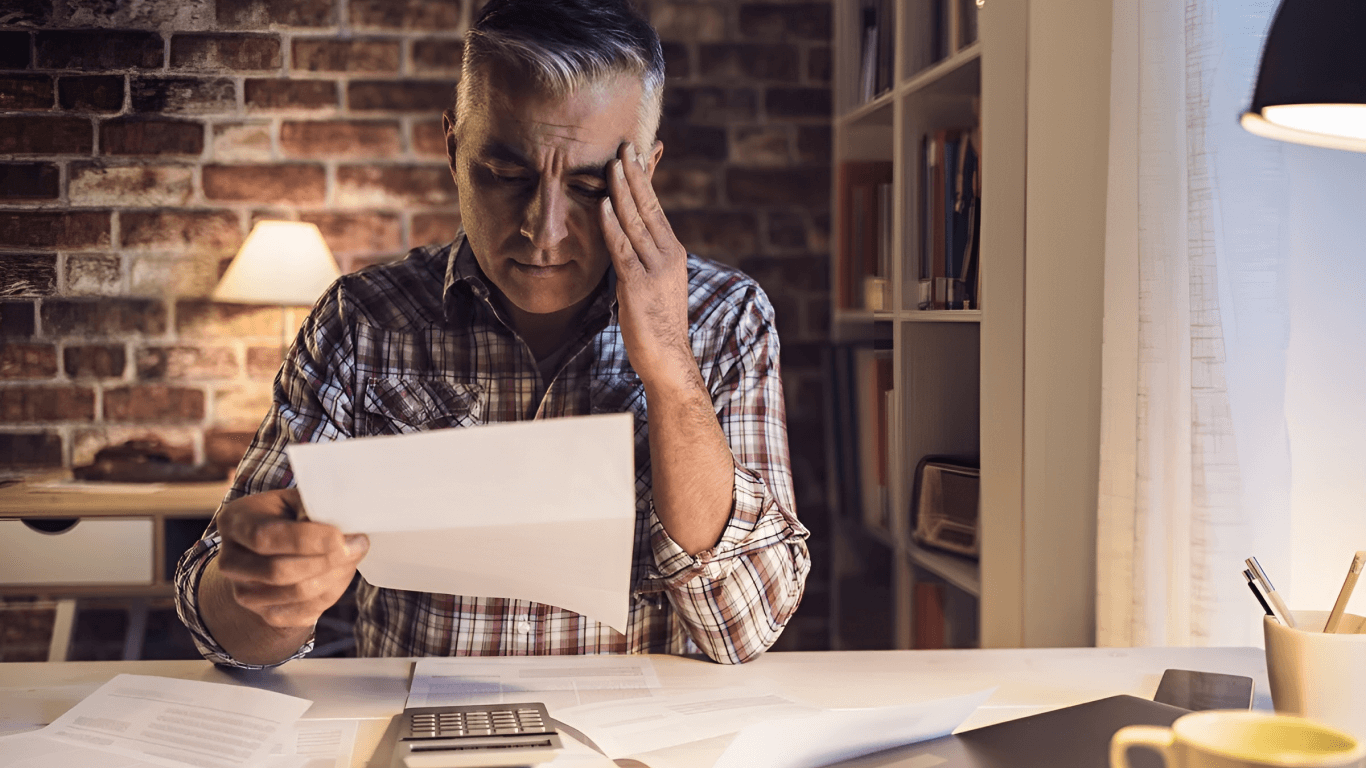

“As a small business owner who has really struggled for two years through the impact of COVID-19 and long lockdowns and loss of custom, now I am facing a rise in cost of living, inflation and mortgage payments. I had proudly been a debt-free individual, but I started struggling with so many things beyond my control. I needed to prioritise my life so that I could keep my business afloat and ultimately leave a legacy for my family. But the truth was I was only treading water: finding the money to pay staff, cover the mortgage, buy groceries and put petrol in the car. I couldn’t breathe. It felt like Groundhog Day. Then came the floods in Auckland, and while my business only suffered a little bit of damage, it still put my insurance premiums up. I heard about NSBS and the mentoring support and financial stress relief they could offer, and I quickly signed up to the BFC programme. I wanted to better manage my money and reduce the burden of financial worries so that my family and I can all live happier and more fulfilled lives. And I have never looked back.”

All NSBS financial mentors are professionally trained and fully accredited by FinCap, the non-governmental national body, and licensed to work in the financial capability sector. NSBS runs an independent school where students undergo the intensive and accredited Financial Mentor Training Course (FMIC). The NSBS Mentor Academy is the nation’s leading provider of financial mentor training.

Jane Be knows what it is like to feel the shame, embarrassment and helplessness of being in debt and the overwhelming stress of trying to find a way out.

“I didn’t tell anyone about my debt. Not my family. Not my friends. I felt ashamed. It was really hard to hold on to those emotional feelings, and even though my debt was relatively small, it still took me a long time to pay off and a big toll on my health and wellbeing,” she said.

The payroll executive worked overtime and took on extra jobs to pay off her debt. She felt alone and spent many sleepless nights worrying about money. “I didn’t know budget mentoring existed at the time,” Jane said. “Now I know there are specialists like NSBS who are happy to listen and help you through your money problems with no bias and no judgement.”

The sense of liberation when the arrears were paid off was immense. So much so, Jane felt her reward was to give back to her community and to let others like her know that help is available.

Jane signed up to the NSBS mentor school and successfully completed the Financial Mentor Introductory Course (FMIC), an intensive training programme for people wanting to become a financial mentor. Jane graduated top of her class, and now she volunteers at NSBS every week to help others who find themselves in a financial predicament. She’s proud of how far she has come, and wants others to feel that same sense of self-worth and freedom from money stress.

“I got myself out of debt and now I mentor others. It’s a fulfilling, rewarding role and a privilege.”

If you would like to book a financial mentoring session with Jane, or with any other NSBS financial mentor, please contact info@nsbs.co.nz or 0800 283 238.

Contact our mentors:

Located: Next door to Takapuna Library

NSBS | All Rights Reserved.

The Building Financial Capability (BFC) programme helps people and whānau to improve their financial wealth and wellbeing and get control

The cost-of-living crisis and the rise in inflation has impacted all household budgets across the country, and as a direct

Grace Foundation offers safe shelter and holistic rehabilitation services to marginalised people including the homeless, single parents, children without parents,

Our successful strategic partnership with Te Puna Hauora has allowed NSBS to deliver one-on-one BFC financial mentoring services to clients

NSBS is one of the only financial mentoring organisations in the country that caters especially to seniors and retirees to

Our partnership with Auckland Council Libraries, in collaboration with ASB Bank, will see the rollout of a pioneering programme offering

NSBS continues to improve the outcomes of Māori and Pacific Island clients and whānau and meet their holistic financial mentoring

NSBS is committed to helping women attain financial independence and security for themselves and their families.Through our BFC programme and

NSBS is committed to fostering financial capability among school-leavers to provide money skills and knowledge for employment preparedness. NSBS financial

Home Partnerships The partnership between NSBS and Citizens Advice Bureau is vital for the community. It allows us to offer